Transfer of Equity | 5 Minute Read.

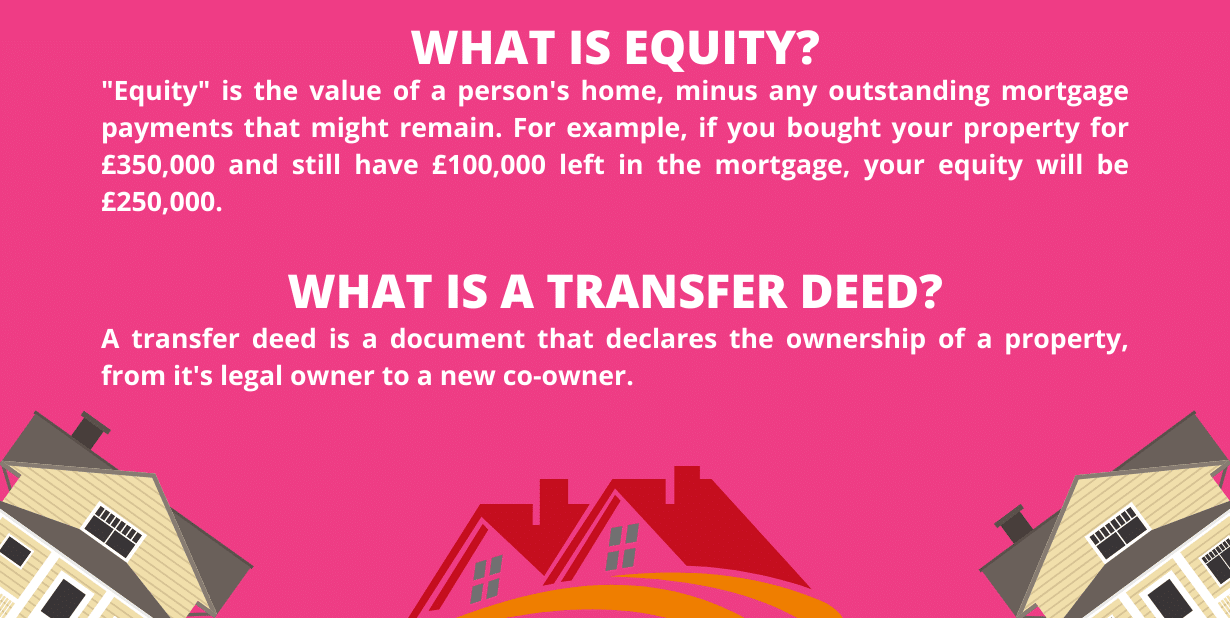

Transferring the equity of a property is the process of removing or adding someone to the property’s title deed. A transfer of equity will often come into play when major live changes occur, yet will allow you to change the ownership of your property without selling it.

Transferring your equity will not affect the “sale” of the property. Instead, the ownership is transferred to a new party, while the original ownership will remain unchanged.

When may i need to transfer my equity?

Transferring your equity will come about during the change in ownership of a property. You may need a transfer of equity if you want to:

- Add your spouse to the property’s deed

- Remove your spouse from the property’s deed, for example, if you are getting a divorce.

- Change the percentage of ownership on a property

- Buy out a co-owner’s share of the property

- For tax purposes; transferring equity to family members or children can be an effective way to minimise tax, although this isn’t always guaranteed.

If you want to put someone, such as a spouse, onto the property’s deed, you can only transfer their portion of the equity, not the whole value of the property. Using our previous example, if the property owner wants to have a 50/50 co-ownership agreement with their spouse, they could transfer £125,000 in equity.

what happens if i still have a mortgage?

How you transfer your equity will depend on whether the property has a mortgage outstanding or not.

1. If the property does not have an outstanding mortgage, then the process is relatively simple. The existing and new owners of the property will need to sign a transfer deed in the presence of a witness and a lawyer. The lawyer will then register the transfer deed with the land registry.

2. However, if there is still a mortgage outstanding on the property, the mortgage lender will need to consent to the transaction. If the mortgage lender does not agree to the transfer, then the mortgage will need to be paid off before the transfer of equity can go ahead.

what is the transfer of equity process?

The key steps in the equity process will be the same, regardless of your lawyer and your reason for making the transfer. You’ll need to consider the following factors when you make your application:

1. If you need to, apply for a remortgage or a new mortgage. You’ll need to do this because the property’s ownership is changing and your new mortgage provider will need to account for this.

2. Instruct a lawyer who will take on the work and the responsibility of your case. This will include prepping transfer documents, registering the transfer with the Land Registry and generally overseeing the process.

3. You and your lawyer will need to notify any other parties of the change, such as mortgage lenders or banks.

Can I transfer the equity myself?

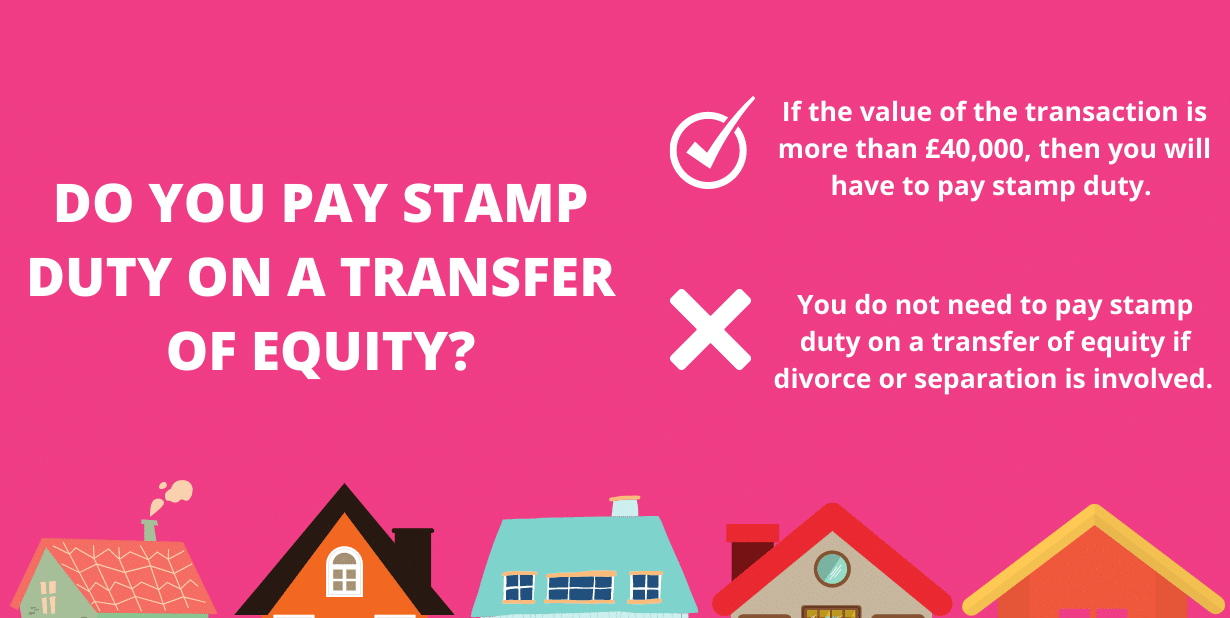

Technically, yes, you can complete an equity transfer without legal assistance. However, be aware that the forms can often be complicated, and each person’s case is different. For example, you’ll need to make certain considerations for stamp duty, tax considerations and ensure you correctly register the property on the land registry.

It’s for these reasons that we always recommend getting in touch with us before you make any decisions. We can connect you to an experienced property lawyer today, to guide you through the transfer process from start to end.

How long does it take to transfer my equity?

It’s hard to give an exact timeline of how long these things take, especially in the COVID climate. However, we estimate that an application could take 4-6 weeks to be completed.

You should know…

Our partner firms are happy to take on both clients who do and do not have an outstanding mortgage.

However, if you still have an outstanding mortgage on your property, the mortgage lender will likely want a lawyer to act for them as well. In this instance, it’s common for the mortgage lender to ask their client to pay for their legal fees.

0 Comments