Home / Legal Areas / wILLS & pROBATE / Estate Planning

estate planning

Estate planning is all about structuring your wealth and assets in a sensible way. Planning your estate will allow you to live comfortably for the rest of your life and ensure as much as possible is passed down to future generations.

Call Today

020 3795 9020

Our Email

INFO@LGBTLAWYERS.CO.UK

Our Address

39 CHURCH ROAD, HOVE, BN3 2BE

Contents for Estate Planning

What is estate planning?

Estate planning isn’t just one area of law. In fact, things like wills, powers of attorney and trusts all fall under the umbrella of estate planning alongside inheritance tax planning and business continuity planning.

The main objective of estate planning is to make sure that all of your assets are divided in accordance with your wishes. You want to ensure that your estate is treated the way that you want it to be after your death.

However, many people also see estate planning as a method to maximise what they pass on. Due to this, estate planning is often done in conjunction with an independent financial adviser who, together with your lawyer, can structure your finances to make the most sense.

Your financial adviser will normally help to plan what happens to your liquid assets such as any cash or investments. While a lawyer will help you to plan for issues such as what happens to your business if you pass away, or how to pass money onto grandchildren.

You should know…

The larger your estate, the more advantageous it becomes to get good legal advice when it comes to estate planning. Smaller estates that fall below the inheritance tax-free nil rate band (worth less than £325,000 total) may not need complex estate planning. However, you should still consider writing a will and potentially having a power of attorney in place.

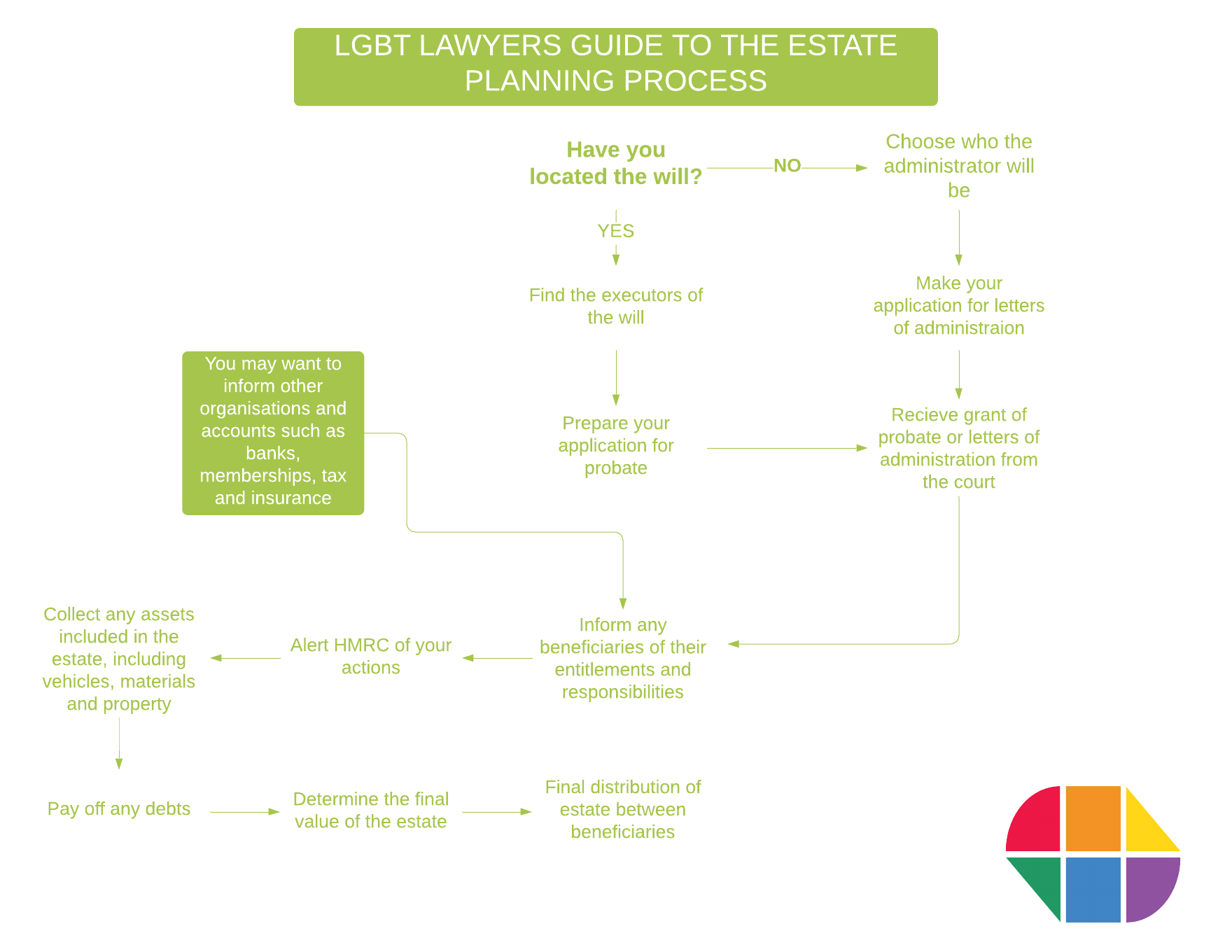

The Estate planning Process

Mapping Out Assets

It’s important that you take the time to do this as it will save time further down the line when it comes to writing your will.

It’s not only larger assets like property and cash that you should note; items of sentimental value should also be written down.

Deciding on an Objective

If you have children and they don’t get on, you might want to consider how to reduce conflict between them by appointing an objective executor for your estate.

One large area of concern for business owners is business continuity, namely how the business will continue running if you are no longer in a position to command it.

Creating a Plan and Taking Action

Depending on what assets you own, and what your objective or objectives are, your lawyer will sit down with you and discuss your options.

At the very minimum, a lawyer should help you to:

- Write your will and create a power of attorney if required

- Understand the risks and benefits of keeping your assets in their existing structure, and how you might alternatively choose to organise them

- Understand the basics of inheritance tax and give basic inheritance tax advice

- Create any documentation to support your overall estate plan, for example a letter of wishes to accompany your will, or a shareholders agreement for your business

- Plan how to deal with any overseas property or businesses

It’s often beneficial to have an independent financial adviser on hand during estate planning meetings to maximise the options available to you. There is often not simply one way to achieve your chosen objective, but different solutions can offer different pros and cons.

How a lawyer can help

Private client and estate planning lawyers are there to ensure your estate is as efficient as it can be.

While writing a will yourself may work if your estate is relatively simple, having a professional review your situation can save your estate thousands of pounds, maximising what your beneficiaries receive.

The most common reasons people seek a private client lawyer for estate planning are:

- They have been previously married and have children with that spouse

- They expect their estate will exceed the £325,000 nil-rate band

- They own a business or have overseas property

- They expect there will be disagreements between their beneficiaries

- They own multiple properties and want to understand how to lessen the impact of Capital Gains Tax

- They want to understand what happens if they lose the ability to make decisions around their own welfare

These are only a few reasons why people seek the help of an estate planning lawyer. If in any doubt, LGBT Lawyers’ expert private client partners can help.

NEED A LAWYER WHO SPECiALISES IN Estate planning?

Get in touch today by giving us a few details and a brief outline of your matter, and we’ll put you in touch with an LGBT Lawyer.

OTHER LEGAL AREAS

CIVIL LITIGATION

CRIMINAL DEFENCE

DISCRIMINATION

EMPLOYMENT DISPUTES

FAMILY LAW

IMMIGRATION

LANDLORD & TENANT

wills & probate: latest blog

Executor of Will Duties | A Complete Guide

Being chosen to be an executor of a will can be very daunting. You will be personally liable for various responsibilities that you will have to carry out. Therefore, it's crucial that you understand your role as an executor. If you need help with administering a loved...

Estate planning Not Right For Your Situation?

Haven’t been able to find the information or solution you were looking for? Here are all the wills & probate services on offer from the LGBT Lawyers network.

The LGBT Lawyers Difference

At LGBT Lawyers we tailor our legal services specifically to the LGBT community and everything that being LGBT entails. As an LGBT individual you deserve legal advice that is free from any attitude or judgement. Our network of regulated and qualified LGBT Lawyers will ensure your legal requirements are met.

LGBT Lawyers earnt its fantastic reputation from its fearless commitment to Our clients’ cases

Call Today

020 3795 9020

Our Email

INFO@LGBTLAWYERS.CO.UK

Our Address

39 CHURCH ROAD, HOVE, BN3 2BE

Need a lawyer who specalises in estate planning Now?

Please give us a few details and a brief outline of your matter, and we’ll put you in touch with an LGBT Lawyer.