Home / Legal Areas / Civil Litigation / Debt Recovery

Debt Recovery

An individual or business may be affecting your company’s cash flow and reputation with unpaid debts. Our expert services can put you in contact with a debt recovery lawyer give you advice tailored to your individual needs.

Call Today

020 3795 9020

Our Email

INFO@LGBTLAWYERS.CO.UK

Our Address

39 CHURCH ROAD, HOVE, BN3 2BE

Contents for Debt Recovery

3. Key Benefits of Using a Debt Recovery Lawyer

4. How Can LGBT Lawyers Help You

What is dEBT RECOVERY?

Recovery is defined as the process of getting people or businesses to repay the money they owe. Debt is commonly caused by people or companies who have not paid back the money they have borrowed within an agreed time frame. When arrangements fail between two parties and money is owed, it can be lost without professional debt recovery. It is, therefore, crucial you acquire a debt recovery lawyer to ensure you, or the business does not lose the money owed to you. Please contact us to receive debt recovery advice, or a representative to assist in your debt recovery claims.

You should know…

Debt recovery claims:

1. Small claims below £10,000 are categorised as small claims track.

2. Debt claims up to £25,000 are processed as fast track and claims over £25,000 go through multi-track.

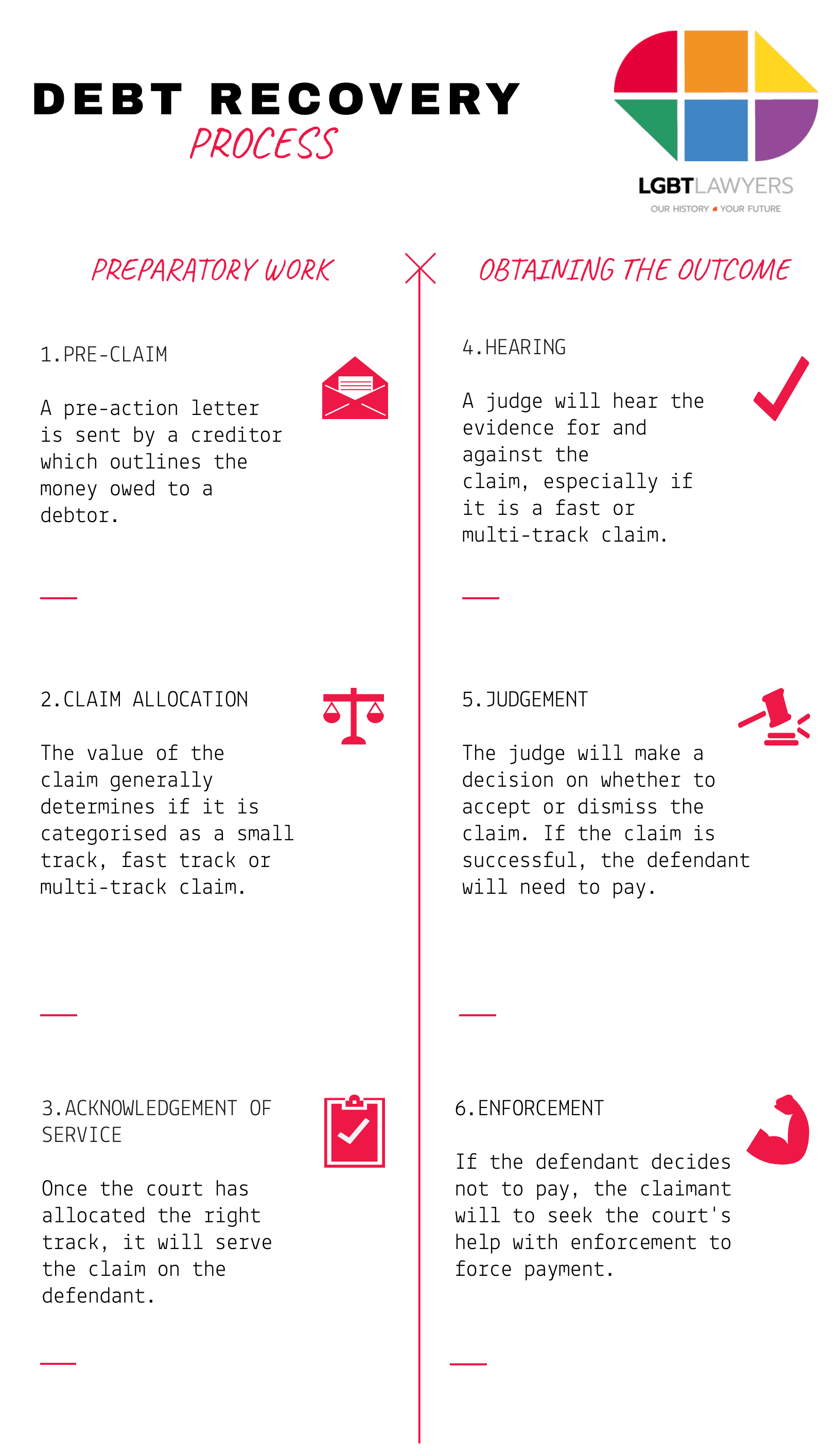

The six steps of debt recovery

Stage 1: Pre-Claim

A pre-action letter or a letter before action is sent by a creditor which outlines to the debtor, they need to pay the money owed. An individual who receives a pre-action letter has 30 days to pay the debt, and a company is required to pay within 14 days. If you are looking to recover debt from outside of the UK, the time limits may vary.

Stage 2: Claim Category

A claim of more than £100,000 will be issued with the high court, and smaller claims will generally be issued in the county court money claims centre. There are set fees which are governed by the value of the debt which determines the court fee required. A claim which exceeds £10,000 has a 5% fee with a cap of £10,000, meaning a price for a claim of £400,000 would only cost £10,000.

Stage 3: Acknowledgement

After the court has processed the creditors’ claims, it will serve the Claim Form on the debtor. Once, the debtor has been served the claim they will have a time of 14 days to file an Acknowledgement of Service or Defence.

Moreover, once the Acknowledgement of Service is filed, the debtor will have a time of 28 days from when the claim form was sent to file a defence.

However, if the debtor decides not to respond to the issued claim within the time frame the claimant can apply to go directly to the court for Judgement in Default. As a result of the claimant going directly for Judgement in Default, a trail would not be required.

Stage 4: Hearing

Fast and multi-track claims are decided at trial. However, claims which are allocated to the Small Claims Track are decided at a final hearing.

The final hearings for small claims are typically informal with the parties sat around a table. Witnesses are not generally required to give evidence under oath. Furthermore, usually, the parties involved represent themselves.

The fast track and multi-claims trials are much more formal in comparison to the small claims. Legal arguments and evidence will be presented using a set format. Moreover, witnesses will normally be required to give their evidence under oath.

Stage 5: Judgement

At the end of the final hearing or trial, the judge will give a judgement, and explain the reasons for the decision.

The parties will then have the opportunity to make representations to enable the judge to decide who shall be awarded costs and how much should be awarded.

It should be noted, successful parties of small claims are typically only awarded minimal sums by way of cost.

Stage 6: Enforcement

The enforcement stage is dependent on the outcome of the acknowledgement stage. For example, if the debtor decides to pay, the creditor enforcement proceedings would not be necessary. On the contrary, if the debtor decides to pay there still several enforcement strategies that can be used to recover the debt. The enforcement strategies include Writ of Control, Warrant of Execution, Charging Order, Attachment of Earnings Order, Winding up Proceedings, Statutory Demand for companies, and Bankruptcy Petition.

Before an enforcement strategy is selected, a solicitor may deem it to be adequate that further investigation is undertaken to analyse the debtor’s assets. Further investigation is essential as it can help to select the correct enforcement strategy, which will have the most success.

Furthermore, in a scenario where more information is required, an application can be filed to the court that requires the debtor to attend court for questioning. If a debtor does not attend court, then they will likely be arrested for contempt of court.

Debt recovery process diagram

Key Benefits of Using a debt recovery lawyer

1. Options

A lawyer who specialises in debt recovery will be able to analyse your individual situation and offer the best strategy, the risks involved and what the outcome could potentially be.

2. Alternative Dispute Resolution

By acquiring a litigation lawyer they can evaluate the most suited form of ADR to recover your debt. Furthermore, if ADR is not suited they are able to write and apply to the court on your behalf.

3. Confidentiality

Debt recovery can be a sensitive dispute to resolve and can affect the future business relationship for companies. However, using a lawyer can stop this happening and help you to settle your case out of the public eye.

4. Reduce stress settling outside of court

Court processes can drag on for months and years. In debt recovery matters, in particular, this can be draining on the individuals involved whilst they wait to give evidence, and for an outcome to be reached. However, a lawyer may be able to offer options such as using alternative dispute resolution to settle the debt claim outside of court.

5. Structure

A litigation lawyer can structure a coherent and comprehensive case to your circumstances in an objective manner and without emotion.

How Can LGBT LAWYERS HELP YOU

Having a litigation lawyer on your side during debt recovery will help you understand how strong your case is, and how credible the other side’s evidence is.

Debt recovery can be resolved using forms of alternative dispute resolution, which avoids you having to settle a debt recovery matter in court. A lawyer can advise you on the best options available, be it, arbitration, adjudication or mediation. They will ensure you select the best option available to recover what is rightfully yours.

Additionally, if it is not possible to settle using alternative dispute resolution, a litigation lawyer can build you a strong case, and provide you with expert representation in court. Furthermore, using a lawyer will save you time and money by applying to the court on your behalf.

NEED A DEBT RECOVERY lAWYER NOW?

Get in touch today by giving us a few details and a brief outline of your matter, and we’ll put you in touch with an LGBT Lawyer.

OTHER LEGAL AREAS

CRIMINAL DEFENCE

DISCRIMINATION

EMPLOYMENT DISPUTES

FAMILY LAW

IMMIGRATION

LANDLORD & TENANT

WILLS & PROBATE

Civil Litigation: Latest blogs and insights

Data Breach Compensation | How To Make A Claim

In the UK, recent reports presented that there were 1,767 publicly reported data breaches in 2021. In total, these data breaches amounted to 18.8 billion personal data leaks. As a result of data breaches becoming more prominent, we have explained everything you need...

Debt Recovery Not Right For Your Situation?

Haven’t been able to find the information or solution you were looking for? Here are all the civil litigation services on offer from the LGBT Lawyers network.

LICENSING REVIEW

PROFESSIONAL NEGLIGENCE

PROFESSIONAL NEGLIGENCE

LICENSING REVIEW

The LGBT Lawyers Difference

At LGBT Lawyers we tailor our legal services specifically to the LGBT community and everything that being LGBT entails. As an LGBT individual you deserve legal advice that is free from any attitude or judgement. Our legal partner Britton and Time Solicitors is a regulated and LGBT-friendly firm that will ensure your legal requirements are met.

LGBT Lawyers earnt its fantastic reputation from its fearless commitment to Our clients’ cases

Call Today

020 3795 9020

Our Email

INFO@LGBTLAWYERS.CO.UK

Our Address

39 CHURCH ROAD, HOVE, BN3 2BE

Need a Debt Recovery Lawyer Now?

Please give us a few details and a brief outline of your matter, and we’ll put you in touch with an LGBT Lawyer.