Money Laundering | Read Time 5-7 Minutes.

Money Laundering poses a huge threat to the UK’s financial sector, as it undermines the integrity of the UK’s financial system and international reputation. It is estimated that criminal organisations cost the UK’s economy £100 billion a year. Furthermore, the large volume of criminal proceedings passing through the UK could mean criminal and regulatory penalties being imposed by the UK, EU, and US authorities.

What is money laundering?

When criminal activity generates substantial profits, individuals must find methods to control the funds without attracting the underlying action or people involved. Furthermore, money laundering is the process which allows criminals to manage funds and use illegally obtained money effectively. Criminals use lucrative methods of complex bank transfers and commercial transactions to disguise the origins of criminal activity. Moreover, the process’s overall aim is to essentially allow the criminal to appear to authorities to have made their money legally.

How does money laundering work?

There are various strategic ways criminals use to launder money. Generally, money laundering can be split into four stages:

Stage 1:

Placement: Criminals use the placement of funds to disguise their origin. They use the placement stage as a method to distance themselves from the illegal source. Furthermore, it allows the funds to become more liquid to be either transferred or transformed into other types of financial assets. Criminals use several methods to place money in the legitimate financial system. The most common methods include:

– Placing the illegal proceedings through a legitimate business which often deals with cash transactions. Furthermore, these business types are used as it can be difficult for authorities to distinguish between legitimate and false transactions.

– Criminals break down the illegal funds into smaller quantities to be fed slowly into banks without triggering AML threshold alters.

– Paying false invoices to criminal associates.

– Smuggling the criminal proceedings overseas to jurisdictions with weaker AML controls.

At the end of the placement stage, the illegal funds are still easily traceable. However, stage 2 of money laundering allows criminals to remove the traceability.

Stage 2:

Layering: is one of the most complicated stages involved in laundering money as it incorporates multiple financial instruments and transactions that aim to confuse AML controls. Furthermore, layering often entails the international movement of illegal funds. The layering financial transactions’ main aim is to obscure the audit trail and break the link with the original crime.

Stage 3:

Integration: Most commonly, criminals move illegal funds electronically to different countries. After, they then divide the funds into investments and inject them into overseas markets. Moreover, the aim is to continually move the funds while exploiting loopholes in legislation to decrease detection. However, there are other methods used in the layering stage; some of the most common strategies include:

– Investing in real estate.

– Reselling high-value goods (such as jewellery, stocks, shares and art).

– Converting cash into financial instruments (such as wire transfers, insurance, bonds, and letters).

– Investing in legitimate businesses.

– Acquiring professional intermediaries to handle transactions.

Stage 4:

Post-layering: refers to the point at which the criminals have engaged in the layering process for enough time. Moreover, the criminals can remove their funds and integrate them into the financial system as legitimate income. Furthermore, there are various methods which can be used to reintegrate the funds back with the criminal. However, the main aim is to use strategic steps not to draw the attention of the authorities. Commonly, criminals purchase property, jewellery, or automobiles.

What is done to prevent money laundering?

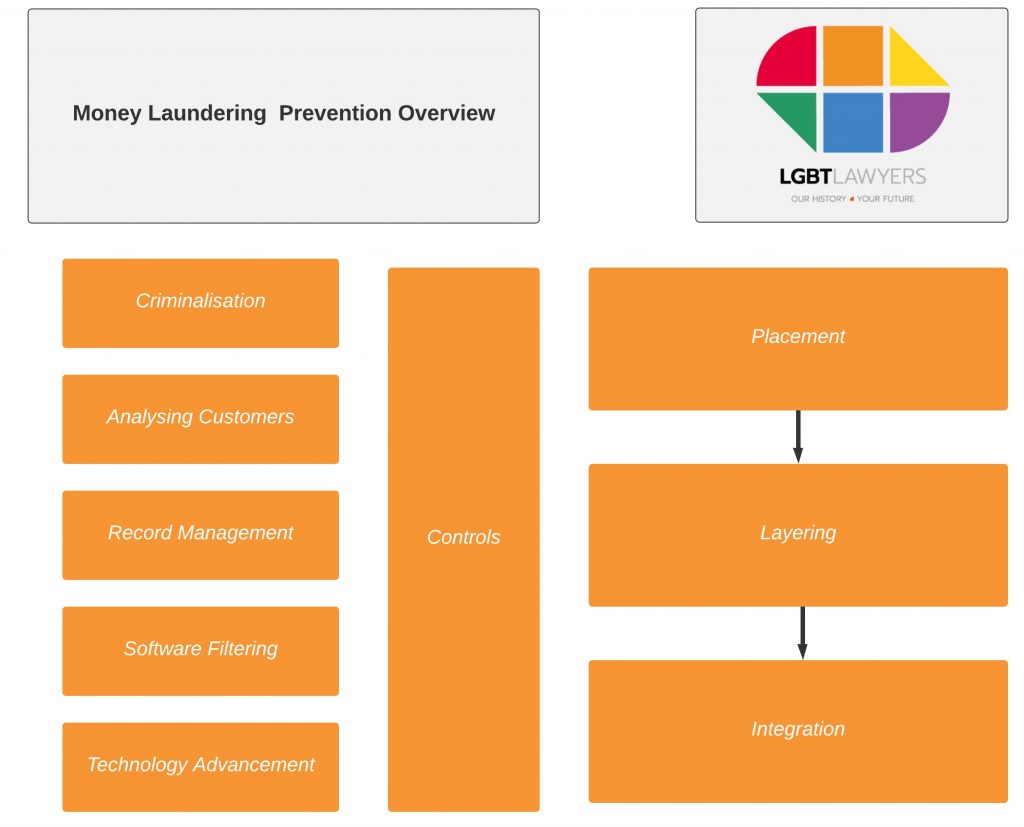

The diagram below presents the three stages of money laundering and how controls are implemented as prevention mechanisms.

1. Criminalisation

Various Governments, businesses and financial institutions implement controls to reduce the risk of money laundering. Furthermore, The United Nations Convention Against Transnational Organized Crime has guidelines which assist governments in prosecuting individuals involved with money laundering operations.

2. Know Your customers

A critical preventive measure used by banks is training employees to assess contextual information. This may include the customer’s body language, comments, and official documents. Furthermore, many institutions refer to the program as “know your client” measure.

3. Record Management and Software Filtering

Within the layering stage, there are various mechanism’s which are used to prevent fraudulent transactions. Moreover, Anti-Money Laundering (AML) programs are implemented by financial institutions such as banks to use real-time monitoring to assess and flag indicators of fraudulent transactions. Typical signs which trigger AML programs include:

– Frequent transactions consist of the same amount of money.

– The destination of the funds (high-risk countries or accounts with weak AML programs).

– Regular use of wire transfers.

4. Holding Period

Banks require deposits to remain in an account for a set period. The period is most commonly around five days. Furthermore, the holding period is designed to prevent money from being moved through banks to launder the funds.

5. New Technology

New technology refers to up-to-date technology used to identify suspicious activity linked to money laundering. Moreover, the technology currently used continues to grow with the assistance of AI and big data software companies.

Failure to report money laundering

Many businesses and organisations are exposed to the risk of prosecution for offences which stem from suspicious financial activity. Individuals can be prosecuted under the Money Laundering Regulations Act 2017, which requires individuals to report suspicious transactions. Furthermore, the act is formed of a set regulation which applies to companies in the private and professional sectors. The Money Laundering Regulations Act of 2017 aims to stop people from using businesses to launder money. Moreover, businesses are required to include risk management measures, monitorisation of internal communications, reporting and recording systems.

You must acquire legal advice if your business becomes subject to an investigation matter regarding suspected money laundering. Furthermore, a legal adviser can inform you on anti-money laundering measures to ensure you reduce the risk of non-compliance penalties. Moreover, they can help provide advice and representation in tipping off allegations related to money fraud investigations.

How can you help?

If you are an employee in the financial services or related industry and have any suspicions about the business engaging in money laundering, you must complete a Suspicious Activity Report (SAR). Furthermore, you protect yourself, organisation, and the UK financial institution from the risk of laundering illegal money.

The most efficient way to file a SAR is using the SAR online system. Reports can be made 24/4 using the online version and provide instant acknowledgement. Furthermore, you will receive a reference number, and the report will be processed quickly.

0 Comments